The role of permanent carbon dioxide removal (CDR) from the atmosphere is currently the subject of intensive discussion within the context of developing a new EU emissions reduction target for 2040 and a German long-term strategy on negative emissions. At the same time, a short-term strategy for the coming years is needed to ensure the successful scaling of technologies for what can be called “industrial CDR”. So far, the focus has tended to be on a conceptual discussion of the quantities of CDR that are required to achieve net-zero greenhouse gas emissions; as a result, sufficient attention has not been paid to the question of how and on what time horizon the first large-scale CDR projects can come into being. Some countries have already developed short-term instruments aimed at triggering an initial investment drive into industrial CDR. A comparative assessment of these approaches reveals several viable policy options for targeted CDR scaling in both the EU and Germany.

Initial progress in integrating CDR into climate policy is evident at all political levels. For its part, the European Union regards CDR as an important technology on the way to achieving its net-zero greenhouse gas emissions target by 2050 and is accordingly developing new policy instruments. Meanwhile, in Germany, the previous federal government initiated a process to set CDR targets for the years 2035, 2040 and 2045 as part of the country’s “long-term strategy for negative emissions”.

Since the innovative CDR policy pursued in the United States under the Biden administration is likely to be reversed, there will be an opportunity for the EU and Germany to assume a pioneering role. However, this will require not only long-term goals but also a short-term strategy that focuses on scaling up applications for permanent CDR in particular. This need for action in the short term is based on both the scientific literature (in the case of the EU, e.g. the publications of the European Scientific Advisory Board on Climate Change) and the dialogue with companies considering the production of industrial CDR (for example, in the context of the state initiative IN4climate.NRW).

CDR as a building block of ambitious climate policy

CDR encompasses a wide range of methods that are often categorised into conventional and novel approaches. These methods aim to remove carbon dioxide (CO2) from the atmosphere and store it for periods ranging from decades to millennia, depending on the type of storage. In parallel to the efforts to drastically reduce emissions, it will not be possible to achieve net-zero targets at the international, national or regional level without scaling a broad portfolio that includes both conventional and novel CDR methods.

An important criterion for distinguishing between the individual CDR methods is how long the CO2 can be stored. Conventional CDR in the land use, land-use change and forestry (LULUCF) sector often stores the CO2 for limited periods only. By contrast, novel methods based on CO2 storage in geological formations (carbon capture and storage, CCS) are particularly effective at permanently removing CO2 from the atmosphere. In order to distinguish these CCS-based methods from conventional ones as well as from other novel methods, we refer to them here as “industrial CDR”.

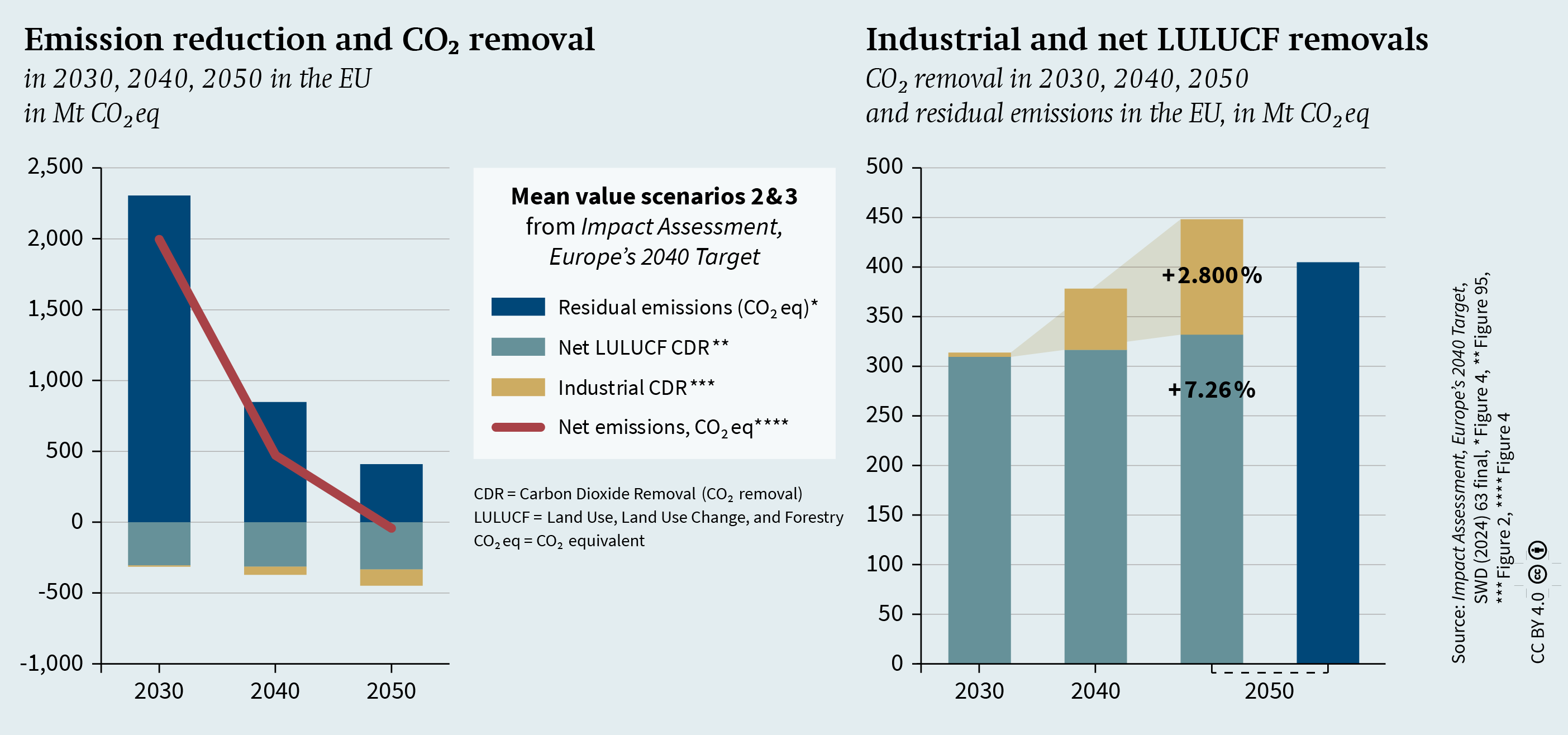

Figure 1 (p. 3) shows the expansion of CDR capacities in the EU by 2050 – as modelled for the European Commission’s impact assessment on the 2040 mitigation target – and makes clear how this expansion must take place in parallel with the drastic reduction in emissions (left panel of Figure 1). It also shows that a target of 310 million tonnes has been agreed for net CDR in the LULUCF sector by 2030 and that, under the various scenarios, removals in this sector will increase by another 7 per cent by 2050. At the same time, industrial CDR would have to be established as a new sector and would need to grow by 2,800 per cent between 2030 and 2050 (right panel). Both scale-ups are associated with significant, albeit different, political challenges.

Insufficient integration of industrial CDR into climate policy

Given the scale of industrial CDR technologies required, it is evident that climate policy at various political levels has so far not paid sufficient attention to those methods. The EU has taken a first step with the voluntary framework for the certification of CDR (Regulation 2024/3012). But key questions remain – for example, whether and under what conditions CDR certificates can be integrated into existing EU climate policy instruments, such as the EU Emissions Trading System (ETS) or the Effort Sharing Regulation.

In Germany, CDR is included in the Federal Climate Action Act (see the targets in §§ 3a–3b) and the Act stipulates that targets for so-called technical sinks (§3b) should be derived from a long-term strategy for negative emissions. However, there is a lack of short-term incentive structures for scaling up CDR projects and infrastructures to an industrial scale. The existing framework conditions for companies are generating investment uncertainty, to the extent that there is a “valley of death” that lies between small-scale innovation prototypes and large-scale implementation projects. This means that for the time being, many CDR projects that are already technically feasible and could be used to implement removal capacities in the short term will not progress beyond the concept stage. And that is why a comprehensive strategy for scaling CDR should not only look ahead to the period 2035–60 but also consider short-term industrial CDR potentials and integrate the necessary incentives into climate policy.

Protracted reforms and short-term capacities

The process of drawing up and implementing an EU-wide policy design for CDR will take time because it is characterised to a large extent by path dependencies of existing instruments at the various political levels. Indeed, the structural integration of CDR into the broader climate policy architecture is not expected to take place until the EU instruments are updated for the next decade (from 2031). Moreover, it is unlikely that CDR policy implementation as an integrated component of the EU climate policy architecture will be so far advanced as to generate effective incentive structures before the early or mid-2030s. Until then, political alliances between EU member states and sectors will need to be formed and incentives and funding mechanisms created at the national and EU level that will accelerate the learning curve for innovation in CDR technologies and their scaling. Thus, the focus must be on those industrial CDR capacities that can be considered low-hanging fruit.

Bearing this in mind, priorities must be set and individual applications selected in accordance with clear criteria. Only CDR methods that can be integrated into broader climate-policy developments in the short term and can compete on the market in the long term should receive short-term funding.

The criteria include the ability to store CO2 permanently (more than 1,000 years), a reasonable cost range (in the lower three digits) per tonne of CO2 and system-compatible energy demand. In order to prioritise applications worthy of funding, it should be examined whether there are synergies with carbon management activities in industry and with the gradual development of CO2 transport infrastructure.

In both the overarching governance framework and infrastructure planning and funding practice, the ramp-up of CDR should be considered alongside projects for the capture of fossil CO2 as well as for its storage (CCS) or utilisation (Carbon Capture and Utilisation, CCU). The development processes for carbon management strategies of individual member states such as Germany and at the EU level emphasise that going forward, it will not be possible to avoid CO2 generation in certain hard-to-abate sectors (see SWP-Aktuell 30/2023). Therefore, waste incineration facilities, cement works and lime plants, in particular, will have to be equipped with CO2 capture systems if CO2-neutral production is to be achieved and carbon leakage prevented. At the same time, it is precisely those plants that offer the opportunity to achieve the urgently needed volumes of permanent CDR through the use of biogenic residues as a share of their energy source.

Furthermore, the long investment cycles in industry must be taken into account. Installations that are planned, dimensioned and built in the coming years will remain in operation for decades. This means that the decisions made today to invest in CO2 capture and transport infrastructure will determine CDR capacities in the 2040s – and thus whether the net-zero target is within reach.

Thus, all in all, the synergies between CDR and the capture of fossil CO2 are important for the successful implementation of CDR applications. For this reason, they should be considered as part of a “short-term strategy”.

Policy options: Examples of short-term CDR policy

In some countries, there are instruments currently being tried and tested that aim to close the gap until a long-term market framework is in place. These methods are already incentivising investment. Upcoming initiatives both at the level of the EU and that of member state governments can make use of this initial practical experience to determine the next steps.

The instruments are designed to create new incentives for CDR technologies and promote those methods in a more targeted and effective way than on the voluntary carbon market (VCM). They can be divided into four broad categories: tax credits, direct public procurement, contracts for difference, and competitive tenders or reverse auctions. What they have in common is that they involve state aid that come at a cost to the budget. Given the strained budgetary situation in the EU and many member states, it is imperative that these funds be used as efficiently as possible and not serve as a permanent solution.

The aim is to provide investment incentives until a long-term EU market framework generates sufficient incentives of its own. The instruments discussed below can ensure that Europe plays a pioneering role over the next 10 to 15 years and the necessary investments in the area of CCS and CDR technologies as well as CO2 infrastructure are triggered. The fact that industrial policy goals such as resilience and competitiveness are being pursued alongside climate policy goals was an important argument in those countries that have already developed such instruments. Now it can serve to justify supporting carbon management as a strategic technology in other countries.

Tax credits

In the US, CCS projects have been eligible for tax credits for the geological storage of CO2 as part of the 45Q tax incentive programme since its introduction in 2008; currently, $85 per tonne of CO2 can be claimed. The Biden administration’s Inflation Reduction Act added a CDR-specific dimension to the instrument: if the CO2 comes directly from ambient air (direct air capture, DAC) – i.e., it is not of fossil origin – companies can claim a significantly higher credit of $180 per tonne. Canada, too, is promoting DAC plants until 2030 with flat-rate tax credits of 60 per cent of investment costs (30 per cent from 2031). The credits are attractive for companies because they are relatively easy to claim.

This approach can be used to promote a broad-based CDR ramp-up instead of individual projects being selected. But in the absence of a competitive selection mechanism, the question remains as to how high the required budget would need to be.

The instrument is transferable to the EU context only to a limited extent, as the EU has no authority over taxation. At the level of member state, there would be competition law issues. Thus, the practical implementation would face a number of legal and political hurdles.

Public procurement

Public procurement can also be used to encourage industrial CDR. As part of its Greening Government Strategy, Canada has launched a programme to purchase CDR certificates totalling 10 million Canadian dollars by 2030. In the US, an innovation competition has been launched for the purchase of similar certificates. The Carbon Dioxide Removal Purchase Pilot Prize, announced by the US Department of Energy, is worth US$35 million. In three competition phases, up to ten finalists from four different areas of technology will be awarded purchase contracts of up to US$3 million. Initial projects using various technologies will thereby be offered purchase security while innovation in the area of monitoring, reporting and verification (MRV) will be promoted.

An EU-wide public procurement programme for CDR certificates would send a positive signal to CDR providers based on EU certification standards (the regulation on carbon removals and carbon farming, CRCF). Stable demand at the EU level would be more effective than an array of small-scale procurement programmes in individual member states; however, it could take time for the 27 member states to reach an agreement. For Germany, the goal set out in the Federal Climate Action Act of making the administration “climate-neutral” by 2030 (§ 15) would be a starting point for expanding existing offset programmes to include CDR certificates.

Contracts for difference

The primary aim of contracts for difference (CfDs) is to provide security for investments whose economic viability depends heavily on the development of the CO2 price (and, in some cases, on other price developments as well). This, in turn, depends on a complex interplay of political and entrepreneurial decisions. A CfD can mitigate the resulting investment uncertainty by reimbursing the difference from the agreed strike price. In this way, the state’s funding costs decrease as soon as the CO2 price rises or the costs for climate-neutral energy provision fall. At a certain point, the companies even pay the funds back if the project proves economically efficient.

In the UK, for example, two CfD contract models have been developed for CDR and put out for consultation: the Business Models for Greenhouse Gas Removals (GGR) and Power BECCS. Here, the state covers the difference between the costs (CAPEX and OPEX) and the revenues from the by-products or the VCM over a period of 15 years.

One major advantage of this instrument is the funding efficiency: first, the contracts are awarded in a competitive process; and second, there are no windfall profits when, for example, operating costs fall more sharply than expected. For companies, CfDs are a hedge against price uncertainties and thus make it considerably easier to reach a final investment decision. However, CfDs over 15 years impose a public-sector financing requirement that is difficult to calculate, since the total amount of funding depends ultimately on unforeseeable price developments. If CfDs are re-tendered on a regular basis, the risk can be better assessed over time and thus managed through the volumes tendered.

At the EU level, CfDs are playing an increasingly important role as they can effectively complement the existing architecture of climate protection policy, at the core of which is the EU Emissions Trading System. As regards feasibility in Germany, experience with this innovative funding instrument already exists in the form of Carbon Contracts for Difference. This experience could be built upon going forward.

Competitive tenders and auctions

Denmark, Sweden and Switzerland have all steered clear of the opaque budgetary burden associated with CfDs by tendering or auctioning a fixed funding amount. For example, Denmark has already successfully organised two tenders in recent years through the CCS Fund and the NECCS Fund (specifically for biogenic CO2). The cheapest price per tonne of CO2 removed was ultimately the decisive criterion in both bids; and in order to lower the price, tender participants could deduct revenues from the VCM. Another round of the CCS Fund tender, which promotes the capture of both fossil and biogenic CO2 on an industrial scale (at least 100,000 tonnes of CO2 per year) and has around 4 billion euros at its disposal, is set to run until 2026. The tender process is complex and takes place in several negotiation phases over a period of some eighteen months. This leaves plenty of scope for criteria other than the price per tonne of CO2.

Sweden’s reverse auction for contracts of up to twenty years for bio-CCS projects, with around 3 billion euros to be transferred on a yearly basis until 2046, is more simply designed: all that counts is the fixed price per tonne of CO2 removed. The aim is to promote CO2 capture at existing plants where at least 50,000 tonnes of biogenic CO2 are produced annually and used not solely for CDR but primarily for another production purpose (e.g., combined heat and power plants or biorefineries).

While this kind of fixed subsidy for each tonne of CO2 removed from the atmosphere offers certainty for public budget planning, an instrument designed in this way carries the risk of the winner’s curse: if the winning bid is based on overly optimistic assumptions about price developments, the project might not be realised in the end. In other words, the instrument could miss its target.

Another example of a tender is the funding competition in Switzerland (worth 100 million Swiss francs), although this is not exclusively concerned with CDR.

Since the competitions in Denmark and Sweden have already passed the EU’s state aid rules, it seems feasible that similar such programmes could be implemented in other EU countries.

A portfolio of instruments

Anyone planning new initiatives for industrial CDR should take into account the experiences of other countries and enter into a bilateral exchange. From the comparative assessment in Table 1 (p. 7), it can be seen that the four instruments presented here have different strengths and weaknesses: there is no clear winner. In future deliberations, an important question – alongside political priorities and path dependencies – will be at which political level the selection of instruments would have to be decided.

Within the EU’s multi-level system, there are significant political and legal hurdles to tax credits in particular. However, the other instruments would have to be thoroughly examined, too. The fact that CfDs and competitive tenders and auctions are already being used in some EU member states should facilitate their transfer to other member states and allow them to be designed in a way that complies with state aid rules.

In any case, there is no single approach to designing a “short-term strategy”. Rather, there are several viable options for ramping up the CDR market, each of which carries its own risks and has its own priorities. A combination of approaches should be examined, as well as the extent to which they are compatible with existing instruments. For example, CfDs and competitive tenders or auctions can be used to trigger targeted investment in large-scale industrial facilities, which, in particular, would boost investment in industrial bio-CCS projects, especially in hard-to-abate sectors with process emissions. By contrast, DACCS would probably not do well in a price competition with bio-CCS as it currently entails smaller quantities that are implemented at a higher cost. Thus, other forms of funding – such as support for prototypes and further research and development projects – will be needed.

Building blocks of a short-term strategy

The EU and the German government should seize the opportunity to assume a pioneering role in CDR policy. Not least because of developments in the US – which over the past four years was an important driver of CDR policy – a leadership vacuum could arise. The upcoming legislative processes within EU climate policy, together with the momentum generated by the EU’s Clean Industrial Deal, open up the possibility of combining innovative short-term incentive structures for CDR with other political priorities (such as competitiveness) as well as maintaining and further developing existing climate policy.

|

Comparative assessment of short-term instruments for carbon dioxide removal |

|||||||||||||||||||||||||

++ considerable strength; + strength; o neutral; - weakness VCM = voluntary carbon market |

What the new German government could do is supplement the process of drawing up a long-term strategy on negative emissions with a short-term strategy. The aim should not be to establish a permanent subsidy model. Rather, the top priority should be to steer already pending investment decisions towards timely implementation in order to expand CDR capacities competitively in the medium to long term. Innovations would thereby reach market maturity earlier and a new, promising business sector would be established in Germany and Europe. This would not only help offset the first-mover disadvantages, such as higher prices and additional costs for planning and approval procedures; it would also make it easier to achieve integrated planning and thus efficient operating costs for CO2 transport and storage infrastructures.

Specifically, a short-term strategy should comprise the following five building blocks:

1) An integrated approach to carbon management – i.e., CDR and the use and storage of fossil CO2 (CCU and CCS). Synergies already exist in pending investment decisions; and with a view to securing the CO2 capture and storage capacities needed in the long term, newly built infrastructures could be used initially for fossil CO2 and then increasingly for biogenic CO2 and CO2 from DAC.

2) A structured mapping of CDR capacities that can be considered low-hanging fruit. Based on such an approach, decisions about incentive mechanisms and infrastructures that might serve as a bridge to a long-term market framework for CDR could be made in a more targeted and effective way.

3) An incentive mechanism, either at the EU level or that of member state governments, that prioritises low-hanging industrial CDR capacities that can be implemented relatively easily and quickly.

4) The long-term vision of an integrated European market for all carbon management applications in which the national policies of the member states do not impede the integration of CDR into future climate policy. Cross-border projects – including, perhaps, third countries such as Norway or Switzerland – should be promoted, because the development of CDR capacities will benefit in the long term from the creation of cross-border infrastructure at an early stage.

5) The avoidance of the impression that CDR can make it easier to achieve emissions reduction targets. Even if CDR were to scale up to the extent modelled in the scenarios outlined in Figure 1 above, gross emissions would still need to be drastically reduced to achieve net-zero greenhouse gas emissions. Thus, it is crucial that CDR policy does not undermine conventional emissions reduction.

A strategy comprising these five building blocks would help reduce costs in the long term and thereby enable a more rapid market ramp-up of CDR. This, in turn, would give important segments of European industry a locational advantage on the road to greenhouse gas neutrality. A short-term strategy would ensure that neither time, nor potential nor economic strength is squandered. Indeed, both a long-term and a short-term strategy are needed because in the long run there will be no progress without an EU market framework and binding targets for permanent CDR.

Dr Felix Schenuit is a Research Associate in the EU / Europe Research Division of SWP and on the Upscaling of Carbon Dioxide Removal (UPTAKE) project, funded by the European Union. Domenik Treß is an Expert in the industry division of the state agency for energy and climate protection NRW.Energy4Climate; among other things, he coordinates the stakeholder dialogue on CDR as a member of the think tank IN4climate.NRW.

This work is licensed under CC BY 4.0

This Comment reflects the authors’ views.

SWP Comments are subject to internal peer review, fact-checking and copy-editing. For further information on our quality control procedures, please visit the SWP website: https://www.swp-berlin.org/en/about-swp/ quality-management-for-swp-publications/

SWP

Stiftung Wissenschaft und Politik

German Institute for International and Security Affairs

Ludwigkirchplatz 3–4

10719 Berlin

Telephone +49 30 880 07-0

Fax +49 30 880 07-100

www.swp-berlin.org

swp@swp-berlin.org

ISSN (Print) 1861-1761

ISSN (Online) 2747-5107

DOI: 10.18449/2025C13

(English version of SWP‑Aktuell 10/2025)